China to cut meat imports in 2021

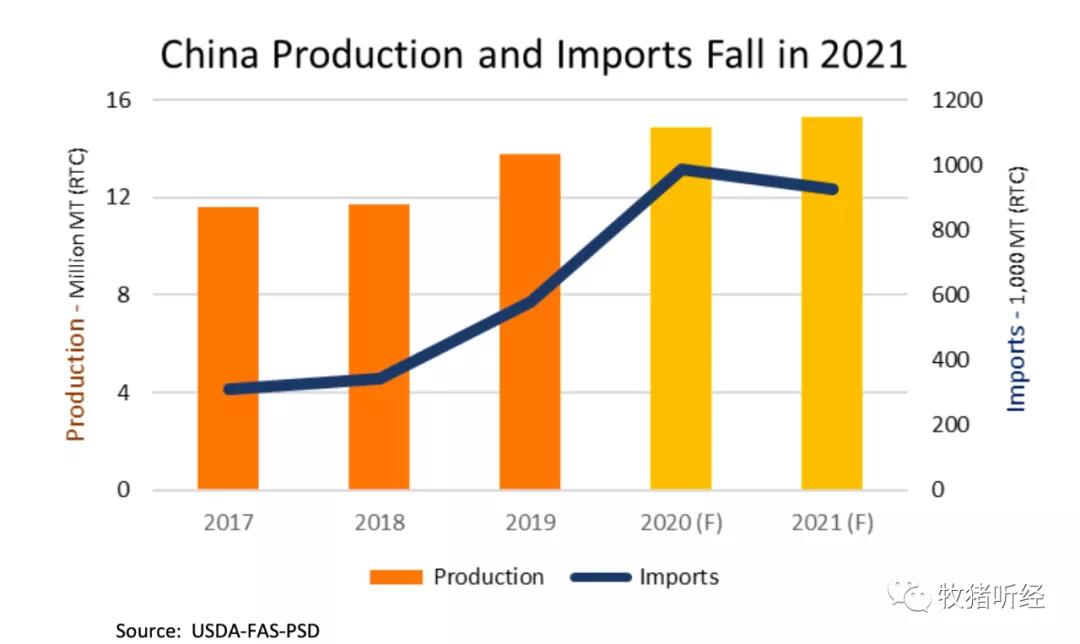

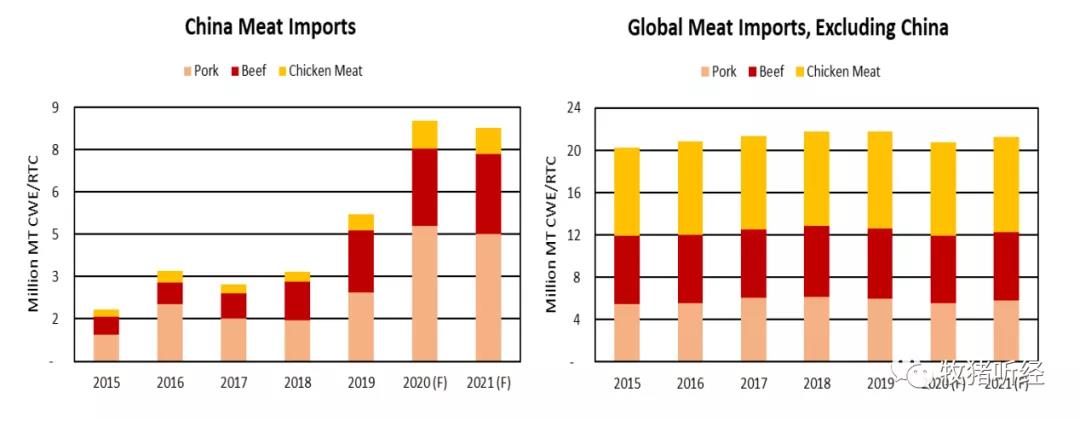

Global meat imports will fall slightly in 2021 as weaker demand in China offsets growth elsewhere. China's meat imports are expected to hit a record in 2020 because of the ASF-induced collapse in pork production. Imports are expected to fall next year as capacity and output recover. Outside of China, global meat imports will largely rebound as the economy rebounds from Covid-19 and demand for food services improves.

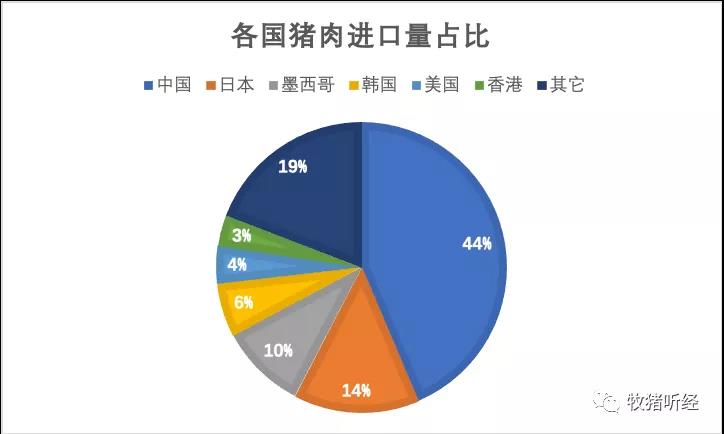

China's pork imports are forecast to fall 6 percent to 4.5 million tons in 2021. Imports will remain near record highs, but are unlikely to exceed 2020 levels because of growth in domestic production. In other countries and regions, pork demand started to grow from last year, while imports hit their lowest level since 2016, mainly due to strong demand from Covid-19 and China. Lower global pork prices are expected to boost shipments in the price-sensitive market.

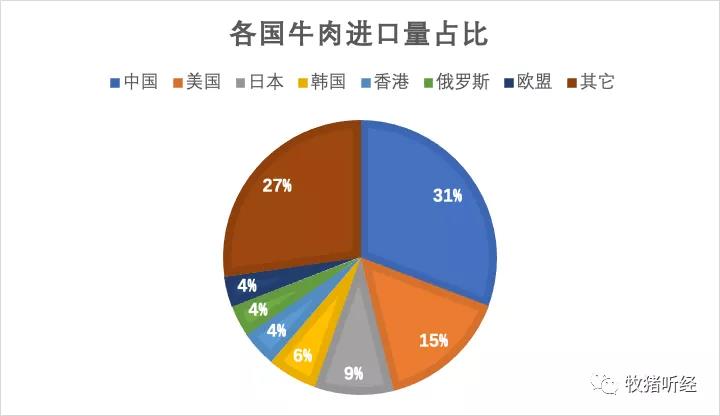

China's beef imports are expected to increase by 4% in 2021

To 2.9 million tons. Changing tastes and relatively modest production growth are expected to support beef imports next year. But the rebound in pork production will slow beef import growth to its slowest pace in five years.

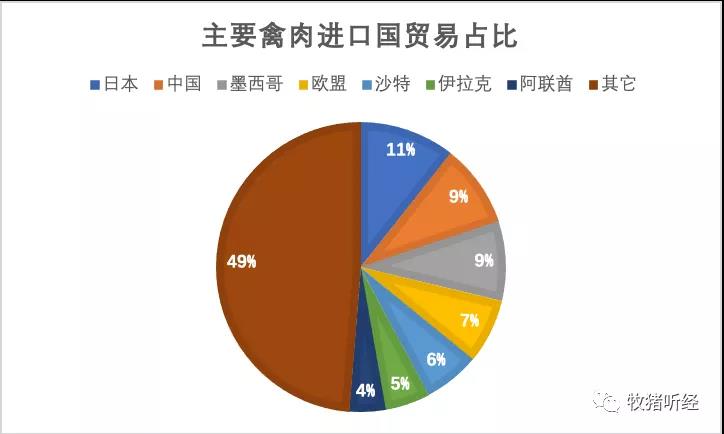

China's poultry imports are expected to drop 6% to 925,000 tons in 2021. Weak import demand is due to increased domestic production and limited consumer willingness to substitute poultry meat for pork, especially given the increased supply of pork next year.

A, beef,

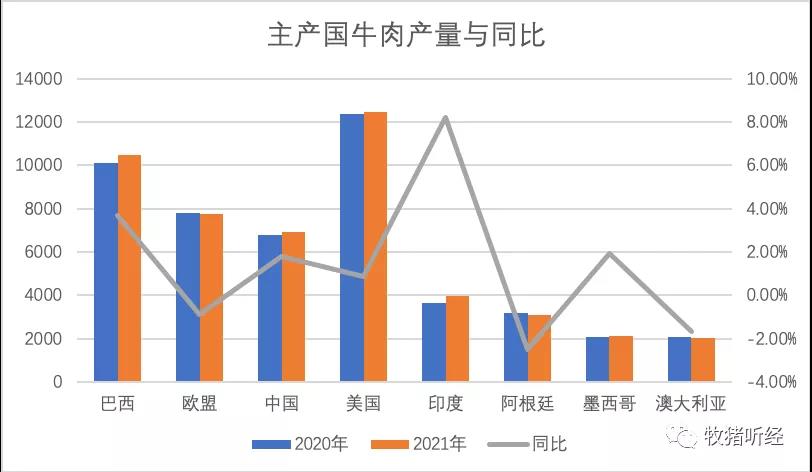

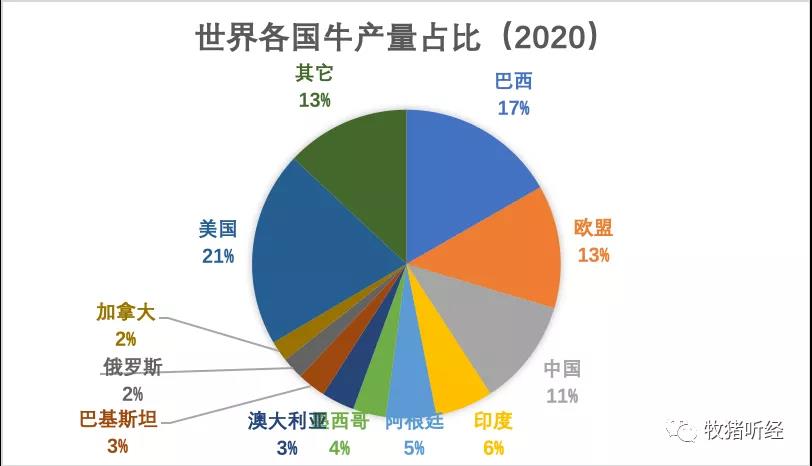

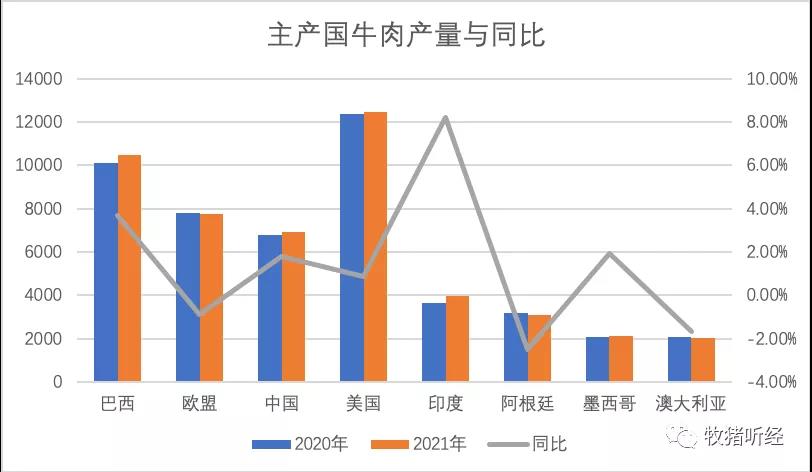

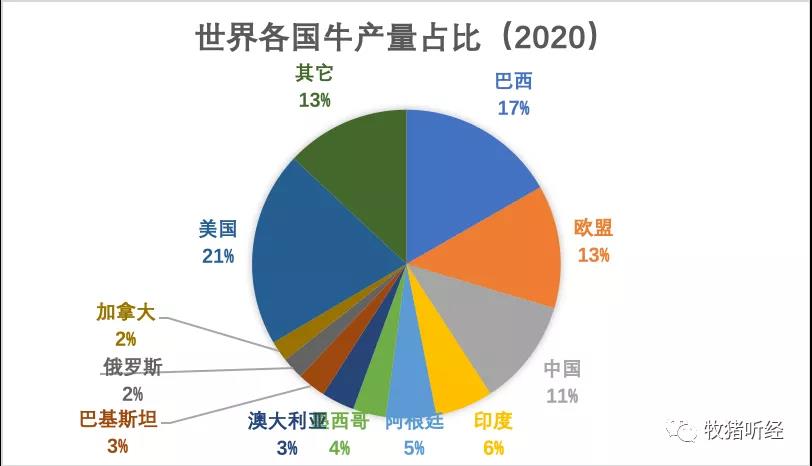

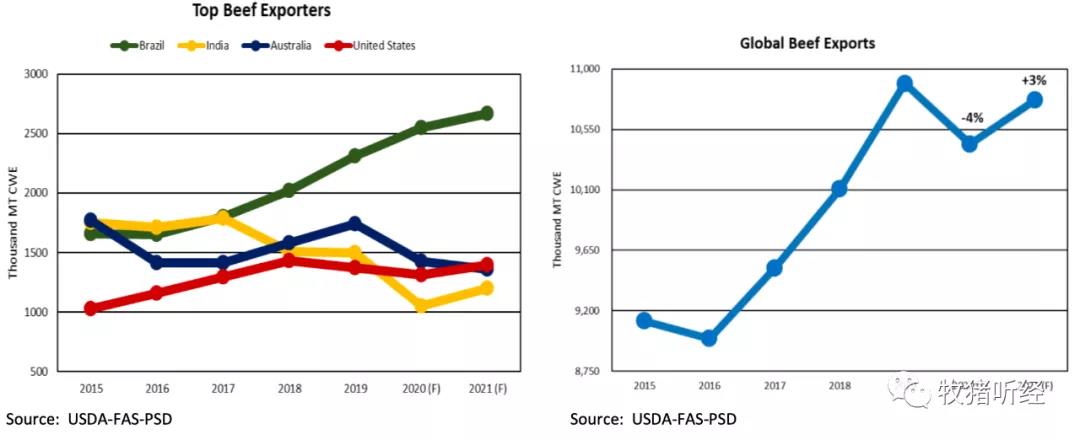

As the global economy improves and industry-supported production recovers from Covid, global beef production is expected to grow by nearly 2% in 2021. Production in India, Canada and the United States is expected to rebound in 2021 after processing disruptions caused by Covid-19 negatively impacted slaughter in 2020. Brazil's production is expected to increase as domestic demand improves, imports from China continue and other export markets recover. In Australia, on the other hand, production is expected to fall for the second year in a row as producers rebuild their cattle after years of drought. Producers are holding back more livestock to breed, and Argentina's decline will also be driven by herd rebuilding.

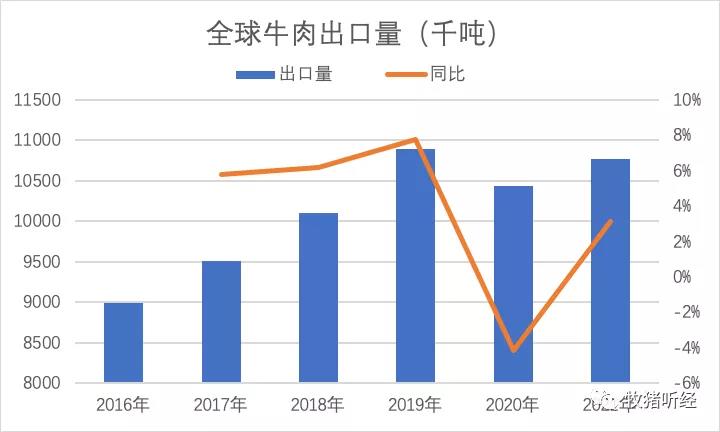

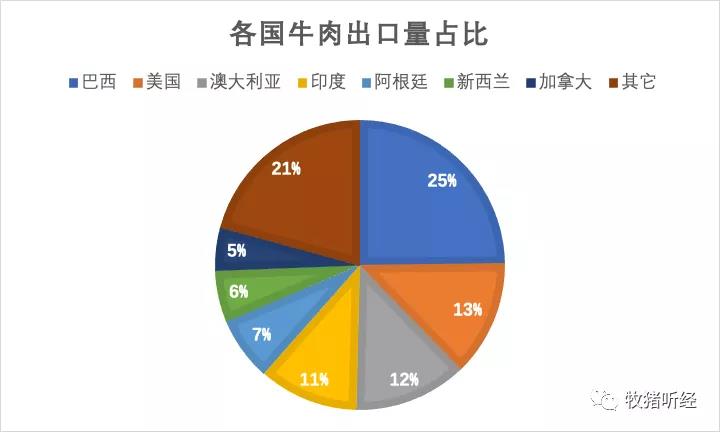

Global exports are expected to grow by 3 per cent in 2021 as improving economic conditions and a recovery in the food services sector support demand. Exports from most major exporters are expected to increase next year. Australia and Argentina are exceptions, as lower production is expected to limit exportable supply. India's exports have been boosted by its high production and economic development in price-sensitive regions. Meanwhile, Brazil's exports are expected to hit a record high for the third year in a row as growing demand from China picks up alongside demand from traditional markets。

U.S. market: U.S. meat production is expected to increase by 1% in 2021 due to larger slaughter volumes and higher slaughter weights. Exports are expected to grow 6 percent, led by higher shipments to East Asia. Australia is a major supplier to many markets in the region and its lower exports are expected to reduce competition. The US is on track to overtake Australia and India as the world's second-largest exporter by 2021, but will remain well behind Brazil.

Second, the pork

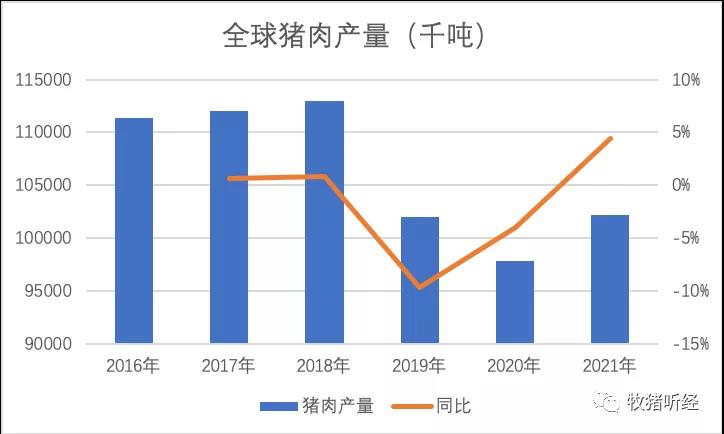

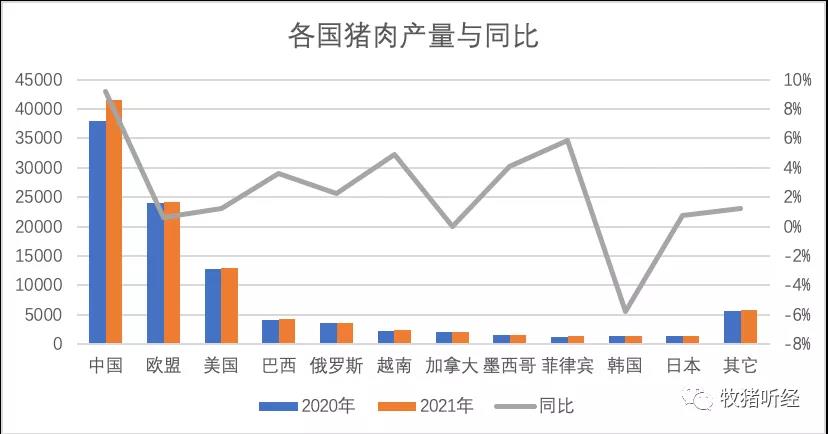

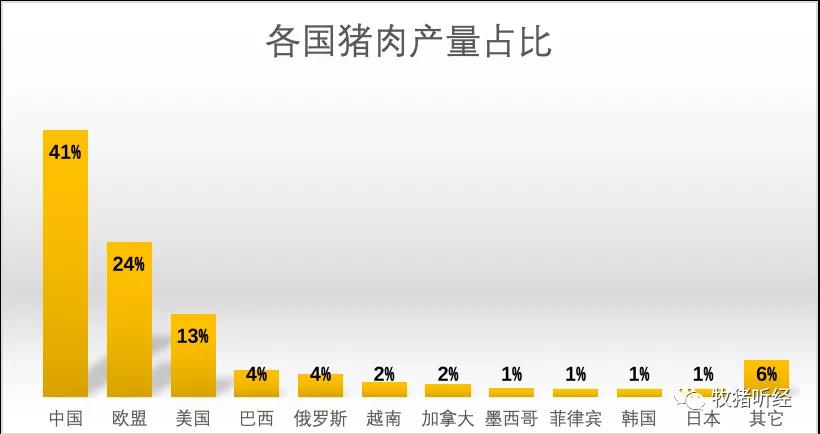

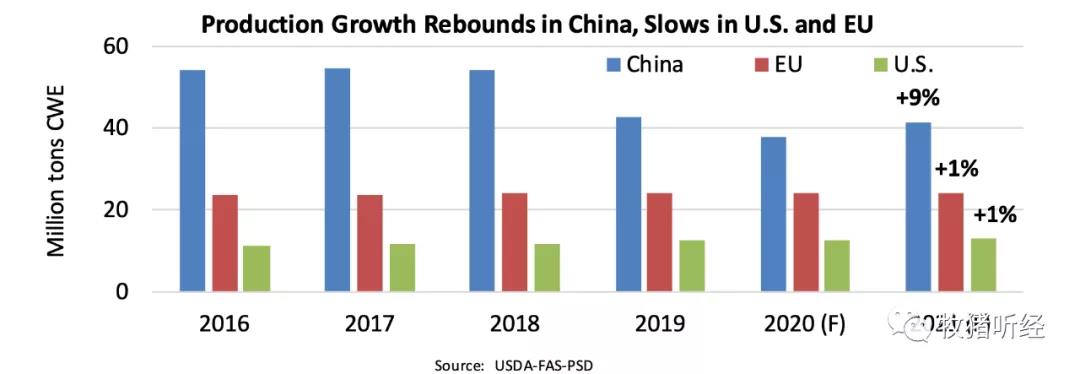

Global pork production is expected to grow by 4% in 2021 as production begins to recover in countries affected by ASF. China's producers, encouraged by high pig prices, are expected to increase production by 9 per cent to 41.5 million tonnes, still nearly 25 per cent below pre-epidemic levels. Recovery from ASF is also driving capacity growth in Vietnam and the Philippines, although the outbreak in Vietnam and the Philippines continues, which may challenge reconstruction efforts. The European Union has seen a slight increase in production on the basis of stable stock levels and productivity growth. The discovery of ASF in German wild boar populations is not expected to directly affect production, but export restrictions will lead to an increase in German pork supplies in an already saturated EU market. Coupled with weak demand within the EU and slowing demand in China, prices are likely to be subdued next year. In Brazil, production is expected to rise almost 4 per cent, thanks to a rebound in domestic pork consumption and relatively firm export demand.

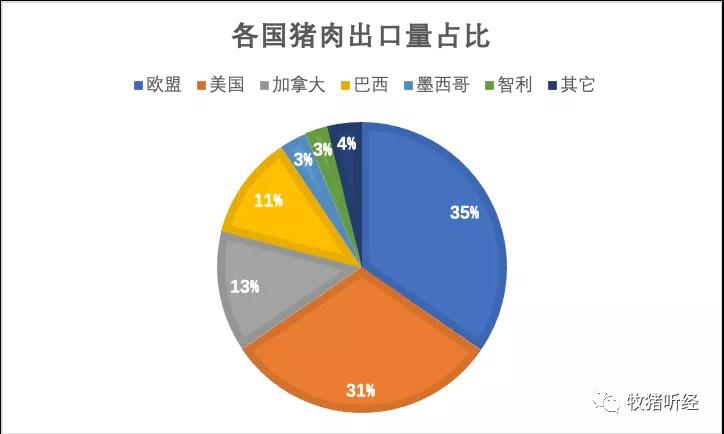

Global pork exports are expected to remain flat at 10.8 million tonnes. Pork demand is expected to rebound from Covid-19, along with improving economic conditions and a recovery in the restaurant and catering sector. But slowing demand in China, the biggest importer, has offset growth in the rest of the world. After tough growth in 2020, China's pork imports are expected to fall 6 percent as domestic capacity begins to recover. Other major pork importers, including Mexico, the Philippines, Japan, South Korea and the United States, are forecast to increase their imports, but those countries combined trade less than one China.

US market: US production is expected to increase by about 1% in 2021, mainly due to moderate growth in slaughter volumes. Producers tend to reduce breeding sows in the second half of 2020 and the first quarter of 2021, which will limit hog supply for most of next year, while slightly lower slaughter weights will also limit production growth. While the domestic market is relatively strong, export demand is weakening. Exports were unchanged at 3.3 million tons as weaker Chinese demand offset growth in other markets, including Mexico and Japan.

三、Three, poultry

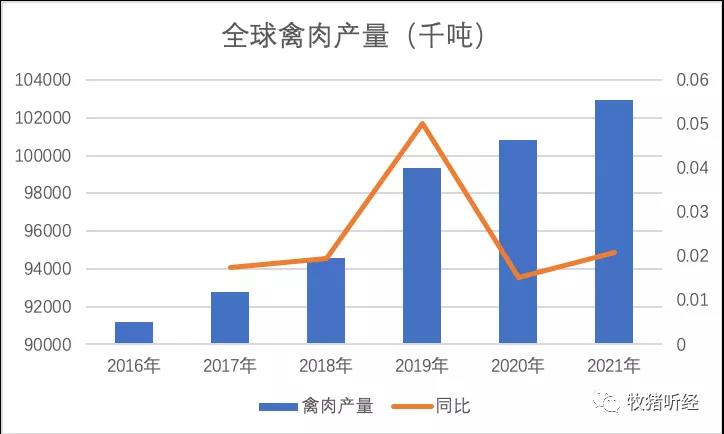

Global poultry production in 2021 is expected to increase by 2% to 10.29 million tons. Restoring hog capacity in China will limit further growth in poultry production, and Chinese consumers have relatively limited alternative consumption of poultry in the event of a pork shortage. Other major producers are expected to see modest increases in poultry production, with notable increases in Brazil, the European Union, the United States and India. Some of the increase in production will feed directly into international markets, while economic growth is also expected to boost domestic demand in major producing countries.

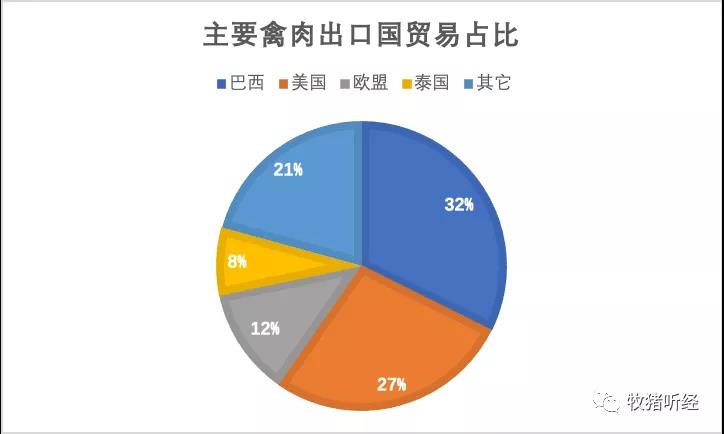

Exports are expected to grow 2% to 1.22 million tons in 2021. Brazil, the world's leading exporter, will account for more than a third of the increase. Brazil's competitive advantage to offer a wide range of products in a wide range of markets at competitive prices will help expand exports to the Middle East and sub-Saharan Africa, which will be crucial for growth in the face of weak Chinese demand. After two years of spectacular growth, Chinese demand is set to weaken, although it remains near historic highs. Globally, the European Union and Saudi Arabia demand

The increase will offset falling demand in China and South Africa.

U.S. market: U.S. production is projected to increase 1% to 20.5 million tons by 2021, with exports expected to remain largely unchanged at 3.3 million tons due to weak demand in most major U.S. markets (especially Mexico).